Contact Us.

- Chartered Accountants 554 ,Aggarwal Metro Heights Netaji Subhash Place New Delhi-110034

- [email protected]

We provide expert attestation services through our

qualified professionals. The service engagements include

performing of audits of financial statements of entities

covering corporates, banks, NGOs etc. The attestation

services include:

• Statutory audits

• Tax audits

• Stock Audits

• GST audits

• Special audits

Company Law and Secretarial Compliances

Start-up Services

XBRL Conversion & E-filing

Retainership Services

Secretarial Audit and Due Diligence

Taxation Services

Stock Exchange Services

ROC representation

Merger/demerger

Other corporate Affairs matters

Information technology audits determine whether IT controls protect corporate assets, ensure data integrity and are aligned with the business's overall goals. This is achieved by SAP Audits.

(OSP) DOT License

PSARA License

ISO Certification

Food License (FSSAI)

Factory License

RNI License

MCD License

Trade License

Health Trade License

Drug License

Cosmetic License

Agmark

Barcode

Import Export Code (IEC)

Shop & Establishment Registration

ESI & EPF Registration

It is a specific part of managerial work, which helps management for conducting operations and evaluating risk, governance process in an effective and efficient way to accomplish entity’s objectives. Assessing Internal controls is intensively beneficial for moderate or big size firms, which contain multi hierarchy departments

Financial consultancy, structuring/restructuring, arrangements of funds from Banks, Financial Institutions, Assisting in Public Issue, Arranging Private Equity and Commercial Papers etc.

Accounting

In the current economic conditions shareholders, regulators and professional bodies are taking greater interest in how companies derive, report, disclose and communicate about their financial position. This environment is driving extensive change across accounting standards. How can we help:

• GAAP conversion

• IFRS reporting

• Ind AS conversion

• Transaction accounting and financial reporting assistance

• Accounting standards and regulatory requirements

A trademark is a word, symbol, design, or phrase that denotes a specific product and differentiates it from similar products. Copyrights protect “original works of authorship,” such as writings, art, architecture, and music. We get all of them registered as well as litigation in any of its fields is handled by us through our specialised expert.

Services on taxation matters encompass consultancy on Direct and Indirect taxation matters as well as handling the grass

root level execution of a vast range of tax requirements from consultancy, panning to assessment and appeals.

We deal in

• Domestic Tax-Income tax

• International Tax-FEMA-Income tax

• Indirect Taxes

• Payroll services

• Transfer Pricing

Is the specialty practice area of accounting that describes engagements that result from actual or anticipated disputes or litigation

We provide various services wrt GST including Internal audit of GST, compulsory audit of GST u/s 35(5), return filing, Reconciliations, compliances, advisory, advance rulings, notices, summons, assessments, appeals and other litigations.

B.com(H), FCA, LLB, DISA, GST Certificate Holder (ICAI), Ex EY

Area of Specialization:-

GST and Risk Advisory

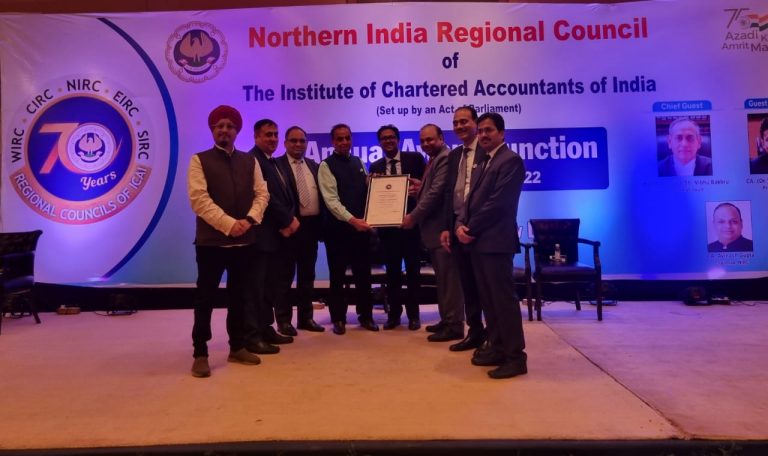

CA. Shubham Agarwal is a practicing Chartered accountant as a partner in firm RSAG & Co. having post qualification experience of approx 10 years. He heads the firms affairs in the field of Statutory Audits, Internal Audits, Banking and regulation, Indirect taxes and Direct taxes along with other partners. He has experience of working with Ernst and young, an MNC in the field of statutory Audits. He is also a law graduate and did his LLB from Faculty of Law, Delhi. He has also done Diploma in information system audit and GST certificate course from ICAI. He has been a special invitee to Indirect Tax Committee (National IDTC) of ICAI. He is also a faculty of GST (trainer) of ICAI. He is an expert in field of GST and has given various seminars on various platforms of ICAI, Nicasa, Doordarshan (TV) etc. He also got featured on CBIC twitter handle for new return system implementation. He has given various corporate training sessions in department and corporates and trained various professionals.

B.com(H), ACA

Area of Specialization:-

Direct Tax and Statutory Audits

CA. Ridima Agarwal is a practicing Chartered accountant as a partner in firm RSAG & Co. having post qualification experience of approx 7 years. She heads the firms affairs in the field of Statutory Audits, Internal Audits, direct taxes along with other partners. She is also a graduate from Delhi University. She has done various PSU audits and has experience in working with Ernst and Young, an MNC, in the field of corporate advisory and international tax. She has a keen eye as an auditor and has to her credentials of unearthing various frauds and errors in companies. She has also handled various Income tax assessment cases in department as well as settlement commission, a quasi judicial body.

B.Com, FCA (Peer Review, Independent Director, FEMA & Arbitration Certificates Holder from ICAI)

Area of Specialisation:-

Direct Tax, Business Restructuring and Advisory

Mamraj Agarwal, Senior member of profession, having vast experience of about 35 years in various matters of Industry & Profession. He has mastered the activities relating to corporate world such as corporate law matter, auditing, acquisitions and mergers, Taxation, liaising, peer review etc. Actively involved in ICAI activities and its committees. Also he is an independent director in some listed companies.

On a personal front also he is a actively involved with various NGOs and charitable trusts which are widely serving the society in the fields of healthcare, medical, education, training and social development.

FCA, Cost Accountant, LLB

Area of Specialisation:-

GST and Customs

B.Tech, L.L.B, PGDIPL

Area of Specialization:- Patent, Trademark, Copyright, Criminal Laws

He is an Advocate & IP Attorney (Registered Patent Agent) based at New Delhi. Intellectual Property Law, Corporate Advisory and Litigation are major areas of my practice. Besides having an extensive experience of handling prosecution for more than 4000 trademark, patent, copyright and design applications. He has advised numerous clients ranging from Start-ups to Fortune 500 companies on various issues including without limitation IP Law, Company Law, Consumer Protection Law, RERA, Alternate Dispute Resolution and Criminal Laws. He has successfully handled numerous contentious litigation before various courts and tribunals in India and is a member of the Delhi High Court Bar Association. His education includes a Biotech Engineering degree from Amity University, an advanced course on Biotechnology and Intellectual Property from WIPO, a Post Graduate Diploma in Patent Laws from NALSAR and a Law degree from the prestigious Faculty of Law, Delhi University.

B.Com (H), ACA

Area of Specialization:- GST

Mohit Gupta is a qualified chartered accountant and has worked with top taxation firms of India. He has more than 6 years of experience in indirect taxation advisory.

He is a two-time rank-holder of CA institute examinations and has been actively involved in the various conventions, conferences of ICAI.

He has been advising clients on a wide range of indirect tax matters including GST, Service tax, Customs, Foreign Trade Policy, Legal metrology law. He has worked with clients in various industries like real estate, infrastructure sector, auto parts, consumer durables, FMCG etc.

He has also trained various CA students as a GST faculty. He has been giving seminars/webinars on various platforms from past several years. He has also given various training sessions in corporates. He has played a key part in preparation of books on various topics under GST, Service Tax and VAT.

FCA, Ex EY

Area of Specialization:- International Tax, FEMA, Transfer Pricing

Sanjay is a Fellow Member of the Institute of Chartered Accountants of India having more than 18 years of post qualification experience. During his tenure at Ernst & Young, he has assisted various oilfield service contractors in their Indian tax & regulatory matters. His key achievements include landmark judgments from the Authority for Advance Rulings (‘AAR’) for seismic companies with respect to applicability of taxes under deeming provisions. He has expert knowledge of key tax and regulatory issues evolving oil & gas industry and have been involved in various tax planning tools for such companies. Gearing companies towards the GST implementation in India and also advising companies operating out of UAE for gearing up with the requirements of VAT. Involved in setting up of subsidiaries for MNCs and conducted due diligence for Indian companies under the Companies Act, 2013. Advising other MNC companies operating in India in the Manufacturing, Retail and service sectors on their tax and regulatory compliances. Assisting OFS companies in contract negotiations & interpretations with respect tax & regulatory implications. He is an expert in the field of FEMA, International tax and transfer pricing. ‘’ He is involved in the capacity of an advisor to the firm”

RSAG & Co," is a professionally managed Chartered Accountancy Firm operating from New Delhi, India. It is a sister concern of Mamraj & Co. which is a 35-year-old CA firm.